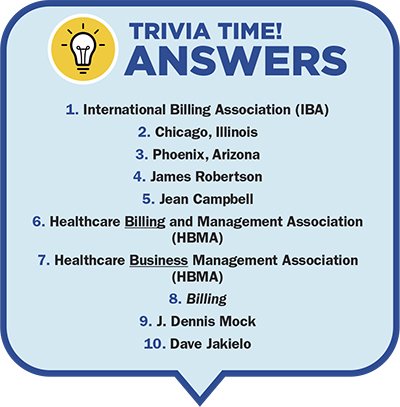

The Healthcare Business Management Association (HBMA) is celebrating its 30th anniversary this year. As a charter member, I thought I would take a trip down memory lane and share some of the history of how the Revenue Cycle Management (RCM) field has and hasn’t changed over the last three decades.

Although HBMA has existed for 30 years, I got my start in 1971 when the field was known as Patient Account Management. In those days, when you submitted a bill to a third-party insurance company, it was usually paid in full, regardless of the amount billed. The only deductibles or copays were contained in policies known as Major Medical.

Only a limited number of insurers enforced a fee schedule. Allowable fees and enrollment/participation in plans were mostly limited to Blue Shield plans. If you raised your fees on an annual basis, the Blues would increase the allowable amounts that they would pay. Even back then, the fees that patients were charged had no relationship to the cost of providing the services or procedures. The strategy was to keep raising fees annually so that the third party would increase their payment amounts.

In the early 1990s, RCM was primarily a manual process that relied on paper-based systems. It was time-consuming and prone to errors. The introduction of computer systems and medical billing software changed the face of RCM. With the advent of RCM software, healthcare providers could automate many of the manual tasks that had previously been performed by hand. This led to a reduction in errors and a more streamlined process.

The decade of the 2000s was the start of outsourcing some of the basic RCM functions such as payment posting, demographics, and charge entry. It was cost-efficient to have offshore employees as part of your team. These companies were mostly located in India.

Then around 2010, the broad adoption of electronic payments and Electronic Health Records (EHR) drastically reduced the amount of manual work needed in the RCM processes.

Offshore teams expanded their expertise and were now assisting with accounts receivable follow-up, denials, provider enrollment, and medical coding. Many of the vendors could handle a claim from creation to adjudication and they became responsible for all aspects of the RCM cycle. Offshore companies are still part of the RCM equation, not only to reduce costs, but in certain regions of our country, it is almost impossible to find employees who want to work in the RCM business. Today, offshore companies are located in over a half a dozen countries and many can handle every function necessary for RCM success.

In January 2020, the first cases of COVID-19 were detected in the United States and the spread began. By March 2020, most billing companies had shuttered their offices, and RCM employees were forced to start working remotely from their homes. We wondered if the quality of our work would suffer because we have never faced a crisis of this magnitude.

However, the RCM process kept humming along and has forever changed how we deliver our services. We found out that working remotely, while not for everyone, actually improved productivity for the people who could adapt, and it was so successful that many billing companies have maintained this model of working remotely and have reduced their office space or abandoned it altogether.

Now in this decade, we are familiarizing ourselves with the tools known as Artificial Intelligence (AI), machine learning, and Robotic Process Automation (RPA) or BOTS, as they are changing the RCM landscape. These technologies are being used to automate tasks, reduce errors, and improve the accuracy of payment and coding processes. For example, AI-powered systems can be trained to identify patterns in patient data and predict the likelihood of claim denials. This information can be used to proactively address issues before they lead to payment delays or denials.

In conclusion, revenue cycle management has come a long way over the last 30 years. From manual, paper-based systems to automated, data-driven processes, RCM has evolved to meet the changing needs of the healthcare industry. Today's RCM systems are more sophisticated and efficient, providing healthcare organizations with the tools they need to manage their revenue cycles effectively and to keep pace with the changing landscape of healthcare.

Dave Jakielo, CHBME is an international speaker, consultant, executive coach, and author, and is president of Seminars & Consulting. Dave is a Charter Member and past president of Healthcare Business Management Association and the National Speakers Association Pittsburgh Chapter. Sign up for his FREE weekly Success Tips at www.Davespeaks.com. He can be reached via email Dave@Davespeaks.com and phone at 412-921-0976.