Strategies to Submit Clean Claims and Reduce Denials in 2021 There are practical steps that you can take to improve your chances of capturing complete, accurate patient data necessary for clean claims while also creating a more efficient, cost-effective workflow. Heather Norris and Daniela Ivey

Submitting clean medical claims reduces denials, accelerates processing, and ensures maximum return. Clean claims contain complete, accurate demographics and insurance details, and are compliant with current federal and state regulations. Despite the criticality of clean claims, deficient and inaccurate data continues to plague billers. According to ZOLL Data Systems’ internal analysis, more than 65% of records run through their AR optimization solution are missing some data, most often name, address, Social Security number, or a combination of fields. A claim missing the patient’s middle initial probably would not be denied, but one that is missing the generational suffix “Jr.” could be. The trickle-down impact prolongs billing processing time, increases denials, and impedes cash flow for medical providers and the billing companies that serve them. In the worst cases, claims extend beyond the permissible window for claim submission or resubmission, resulting in lost revenue opportunities. All medical billing companies must weigh the need for clean claims against the staffing and financial resources needed to ensure them. There are practical steps that you can take to improve your chances of capturing complete, accurate patient data necessary for clean claims while also creating a more efficient, cost-effective workflow. This article takes a look at several new strategies billing companies can apply to partner with their clients and to increase clean claim rates in the year ahead. Top Reasons for Medical Claim Denials Denials occur for a number of reasons. Some are related to eligibility criteria, provider enrollment, or the patient’s plan. According to a December 2020 poll conducted by the Medical Group Management Association (MGMA), 42% of healthcare leaders reported prior authorization as the top reason for denials in their organization, followed by demographic issues (29%), and timely filing (7%). Another 22% reported “other” reasons, including CPT® codes (23%), payer requirement inconsistencies (14%), medical necessity requirements (14%), missing information/documentation (11%), and coordination of benefits (9%). In our experience, payers are notorious for rejecting emergency medicine claims. Especially with COVID-19, hospitals have seen many more acute patients who required emergency medical treatment. If a payer denies treatment that is deemed to be a medical necessity, we may be able to fight the judgment. One of the biggest challenges we face is getting payers to understand that people experience legitimate emergencies that require ER visits. In nonemergent scenarios, if a patient’s plan doesn’t meet the criteria for the diagnosis, the claim is denied and the explanation of benefits (EOB) goes through the clearinghouse, and then to the billing system. Depending on the type of denial, an accounts receivables (AR) work team determines whether an appeal is appropriate. If not, the patient is responsible for the bill, which falls into the self-pay category.

Denial Trend Predicted to Continue in 2021 Consider the example of COVID-19 patients: extreme vigilance is needed to accurately document and report the type and severity of the wide-ranging symptoms associated with coronavirus. To simply state “suspected COVID-19” without details justifying the specific treatments is not sufficient for a clean claim. We’re seeing higher acuity in patients who delayed needed care due to COVID-19 safety concerns and increased volumes in the ER. Even with the vaccine becoming widely available, we anticipate seeing higher acuity cases presenting in the ER for some time to come. Cleaner Claims Begin With Collaborative Denial Prevention

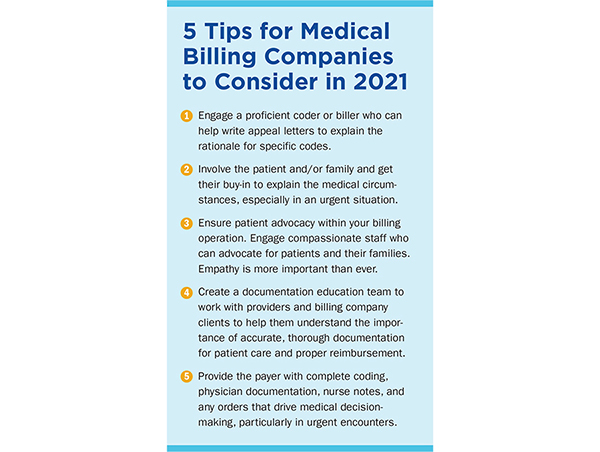

At Keystone Healthcare, our documentation education team has established a proactive process with our providers to identify documentation issues and trends that prevent proper reimbursement. The team includes both clinical and billing members who connect documentation, coding, and billing teams to help providers understand what is required for accurate payment. When a denial occurs, the documentation education team is also engaged to help with the appeal process. Strategies for Preventing and Mitigating Denials in 2021 PREVENT

MITIGATE

Resources

|

Heather Norris is the senior vice president of revenue cycle at Keystone Healthcare. She joined Keystone Healthcare in 2015 and has over 20 years of revenue cycle experience, primarily in emergency medicine, working for some of the largest billing companies in the industry.

Heather Norris is the senior vice president of revenue cycle at Keystone Healthcare. She joined Keystone Healthcare in 2015 and has over 20 years of revenue cycle experience, primarily in emergency medicine, working for some of the largest billing companies in the industry. Daniela Ivey is the product owner for ZOLL Data Systems. She came to ZOLL Data Systems in 2018. She quickly became a certified ambulance coder, knowing that it was the best way to understand and immerse herself in the world of EMS billing. She uses her 10 years of product management experience to identify and solve customer problems in innovative, iterative, and practical ways.

Daniela Ivey is the product owner for ZOLL Data Systems. She came to ZOLL Data Systems in 2018. She quickly became a certified ambulance coder, knowing that it was the best way to understand and immerse herself in the world of EMS billing. She uses her 10 years of product management experience to identify and solve customer problems in innovative, iterative, and practical ways.